Value Added Tax management is a crucial but sometimes intimidating component of the business sector news. Achieving VAT compliance entails precisely computing, disclosing, and paying VAT on goods and services.

Due to the intricate nature of the process, organisations must keep thorough records and stay up to speed with regular regulatory changes. But technology has intervened recently and made a big difference in simplifying this process.

In order to provide businesses of all sizes with solutions that are effective, less prone to error, and easier to handle, we hope to examine how software and technological tools have transformed VAT compliance in this blog post.

VAT Fundamentals

For many firms, fulfilling their financial obligations revolves around VAT compliance. It’s critical to comprehend its fundamental ideas:

Registration: Depending on the jurisdiction, businesses must register for VAT after achieving a specific yearly revenue criteria. Since it formally acknowledges the company’s participation in the VAT system, this registration is essential.

Record-keeping: Maintaining thorough and accurate records is essential. Keeping thorough records of sales and transactions, as well as the VAT incurred, paid, and any recoverable VAT on purchases made for company purposes, is part of this.

Payments and Refunds: A company’s eligibility for a refund or a debt to the government is based on the discrepancy between the VAT collected and paid.

Businesses are obliged to file VAT returns on a regular basis, usually on a quarterly basis. The VAT received from clients and the VAT paid on business purchases must be appropriately reflected in these forms.

Typical Obstacles to VAT Compliance

Even with this foundational knowledge, firms frequently face a number of obstacles:

Regulatory Overheads: Rates and legislation pertaining to value-added tax can fluctuate. To guarantee compliance, businesses need to stay up to date on these changes.

Calculations that are prone to error: When VAT is calculated by hand, mistakes can occur. Errors in the computation or submission of VAT may lead to fines or audits.

Time-consuming Procedures: Manually keeping track of, computing, and filing VAT takes time and takes resources away from other corporate operations.

Complexity in Transactions: The calculating process might get more complicated when different goods and services are subject to varying VAT rates.

How Technology May Be Useful

These problems can be solved with the use of technology, especially software solutions:

Automated Calculations: VAT software can minimise error rates by automatically calculating the VAT owed on each transaction. Moreover, tools like a reverse VAT calculator can be immensely helpful for businesses needing to back-calculate VAT from a total inclusive amount, providing additional flexibility and accuracy in handling VAT-related figures.

Current Information: These systems are updated frequently to reflect the most recent VAT rates and laws, guaranteeing that businesses continue to comply with existing legislation.

Effective Documentation: Digital instruments enable effective and safe documentation. They organise the data they store, which facilitates simpler retrieval and review when needed.

Integration with Business Operations: A comprehensive picture of the financial health of the company is provided by the smooth integration of many VAT software solutions with accounting and ERP software, among other business systems.

Time-saving: Businesses can save a lot of time by automating many of the procedures related to VAT compliance, freeing them up to concentrate on their main business activities.

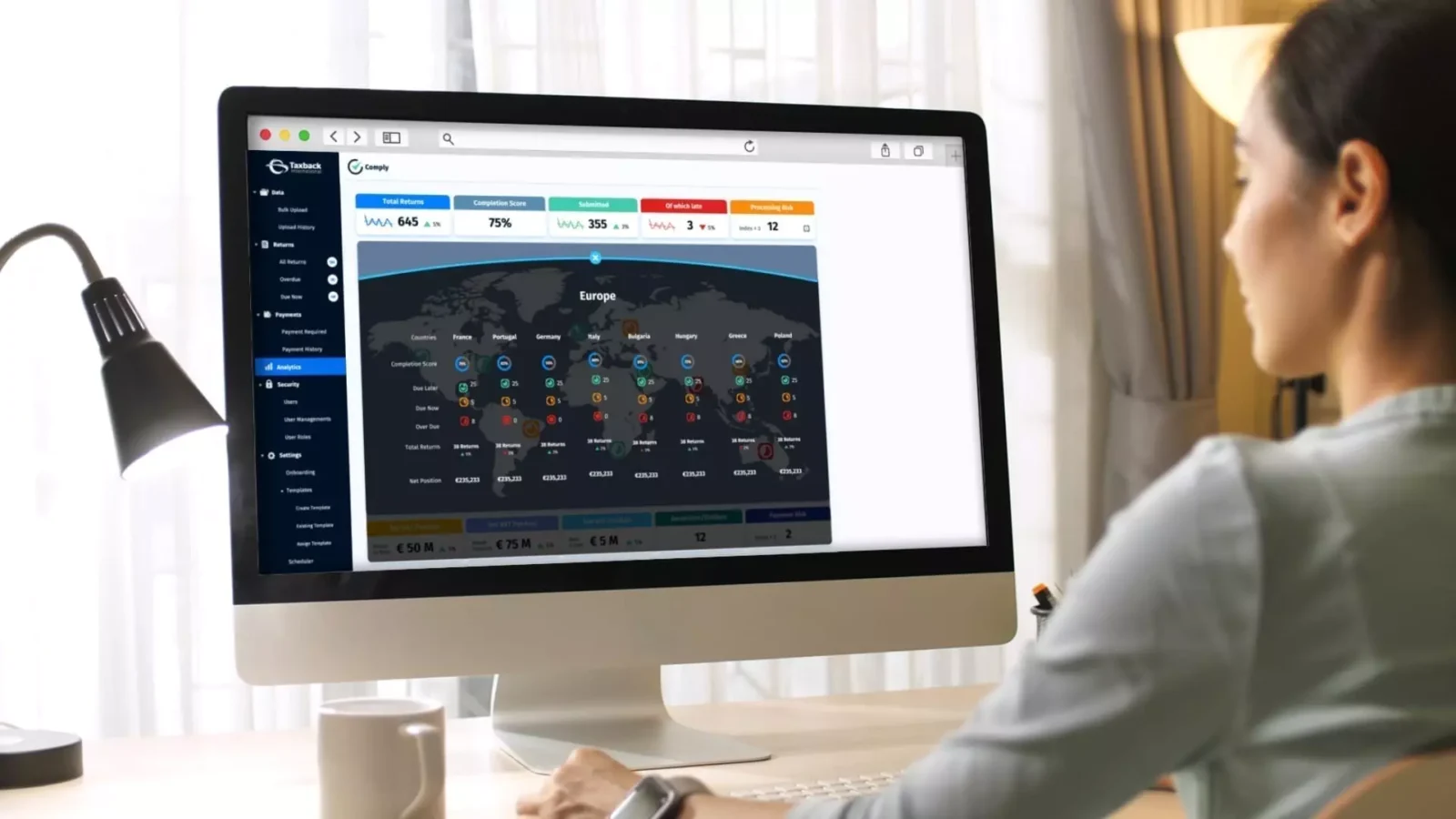

Analytics and Reporting: Advanced VAT software offers reporting tools to assist companies in assessing their VAT obligations and improving their understanding of their financial situation.

Features of Software That Effectively Complies with VAT

For businesses to genuinely profit from effective VAT compliance software, it should have a few essential features:

Calculations that Are Automated: To reduce human mistake and guarantee accuracy, the software should compute VAT automatically for every transaction.

Real-Time Reporting and Analytics: The capacity to produce real-time reporting and analytics is an essential element that provides companies with an up-to-date and transparent understanding of their VAT status.

Integration Skills: To simplify operations and combine financial data, it should easily link with other corporate systems, like ERP, CRM, and accounting software.

Easy-to-use Interface: The programme should have an intuitive interface that makes it possible for users to find what they need without requiring a lot of training.

Data security and backup: It’s crucial to have dependable backup solutions in addition to strong security measures to safeguard sensitive financial data.

Multicurrency and Multilingual Support: Support for several currencies and languages is an important feature for companies who conduct business abroad.

Scalability and Customizability: The programme should be scalable to expand along with the business and able to be tailored to the unique requirements of an enterprise.

Software updates should be made on a regular basis to ensure compliance with the most recent VAT laws and regulations. This will help firms stay compliant.

Selecting Accurate VAT Compliance Software

Many factors need to be taken into account when choosing the best VAT compliance software:

Complexity and scale of the Business: The software you select should take into account both the complexity and scale of your VAT requirements.

Analyse Software Cost vs. Benefits: Compare the software’s price to its advantages, which include time savings, fewer errors, and increased compliance.

Ease of Use: Take into account the software’s ease of use and whether any specialised training is needed.

Software Reviews and Recommendations: Seek out feedback and suggestions from companies that are comparable to your own.

Demos & Trial Periods: Before making a purchase, evaluate the software during these resources. Before making a purchase, evaluate the software during these resources. Many providers offer a redeem code option. It allows potential users to access advanced features or extended trial periods, which can be invaluable in assessing the software’s fit for your business needs.

Excellent customer service is essential to promptly and effectively addressing problems.

The Future of Technology and VAT Compliance

Future developments in technology and VAT compliance are anticipated to be influenced by the following trends:

Enhanced Automation: By lowering the need for manual labour and the possibility of mistakes, additional automation developments will further simplify VAT compliance.

Machine learning and artificial intelligence: these technologies have the potential to forecast VAT obligations, identify patterns, and provide proactive compliance guidance.

Blockchain Technology: Blockchain has the potential to improve the security and transparency of VAT transactions, particularly when doing business internationally.

Increased Technology Integration: A more cohesive approach to finance management should be possible thanks to increased and thorough technology integration with other corporate systems.

The rapidly developing field of regulatory technology, or RegTech, will be crucial in assisting companies in more effectively navigating the challenging terrain of VAT compliance.

Conclusion

Managing VAT compliance can be difficult at times, but it can be made lot easier with the correct technology. Simplifying the procedure and gaining important insights into your company’s financial health are two benefits of using effective VAT compliance software.

As technology develops further, we should anticipate the emergence of ever more advanced solutions that will lessen the strain associated with VAT compliance. Businesses may maintain their compliance, efficiency, and readiness for the future by selecting the appropriate software and keeping up with technological developments.

Leave a Reply